Liquidity package

One of the most important things a broker should look for in a liquidity provider is

the liquidity package, that is, what assets and what liquidity are provided.

Nominal accounts in different currencies are a plus, as is the ability to accept all

leading stable tokens and cryptocurrencies for deposits and withdrawals. These are

just some of the aspects to consider, but it is important to make sure that your

specific needs are fully met.

MT5 Open can help you find liquidity with a wide range of instruments, including

Forex, crypto, spot metals, indices, shares, bonds, and futures. It is of utmost

importance that the liquidity provider gives you access to multi-asset liquidity

along with historical data.

Fast execution

It goes without saying that the liquidity provider should offer the fastest possible

execution of trades with requotes or slippage.

This is very important at the time when market news can have a strong impact.

Market depth

Most liquidity providers use this aspect as a key selling argument. Market depth is

indeed a key factor as it gives an indication of liquidity and depth for a

particular currency, for example.

The greater the number of bid and ask orders at a particular price, the greater the

market depth.

Pricing

This is another key aspect and one of the main aspects that companies would look at

when searching for a liquidity provider.

Liquidity provider pricing should include competitive spreads, not to mention low

commissions and swaps without compromise on either side.

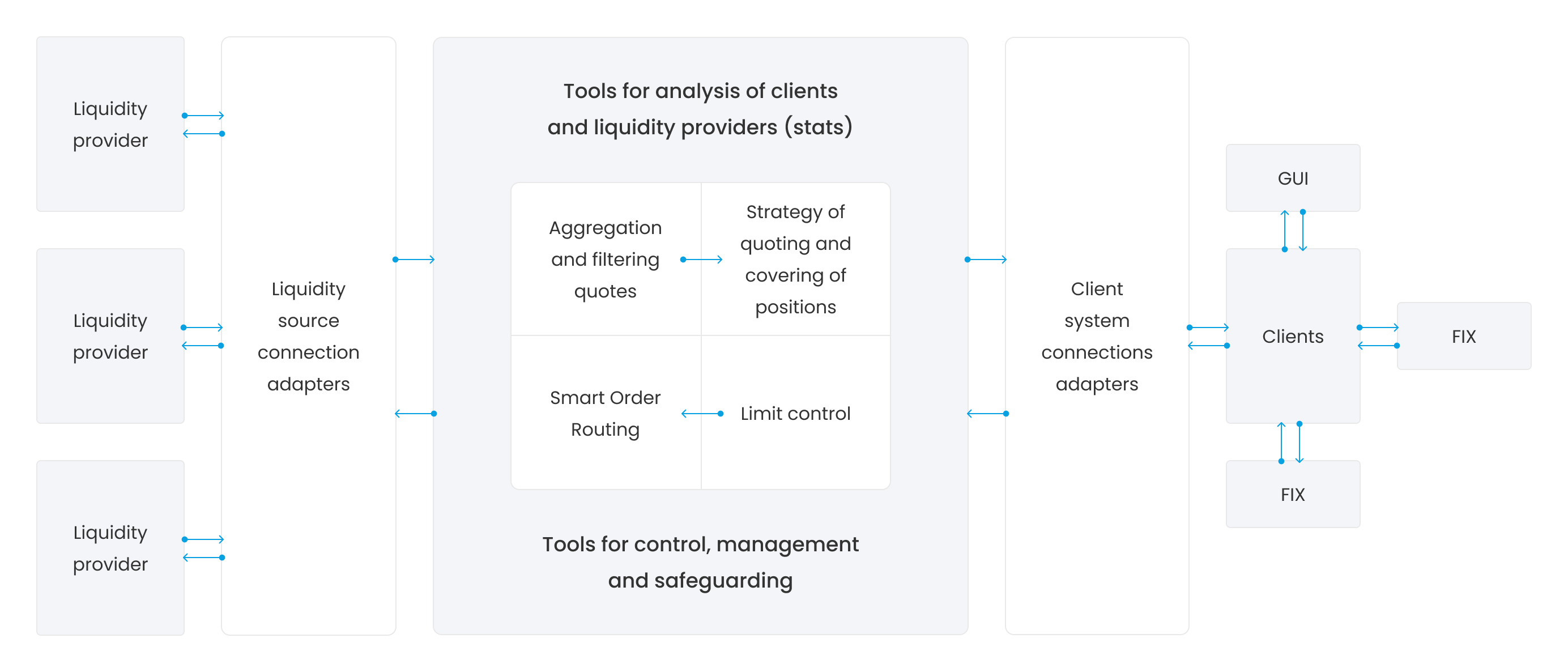

Data flows

The liquidity provider must be able to provide reliable and stable client data flows.

Price flows should reflect real-time prices obtained from all relevant exchanges and

the Forex interbank market. Delays in providing price data are likely to result in

gaps.

Reporting requirements

Reporting is vital for optimal operations. The liquidity provider must be able to

deliver an automated and reliable reporting system, which will also enable your

compliance with regulatory requirements.

Report types to look for are trade reports, FIX bridge reports, swap and rollover

reports, and order book access.

Customer service

The image of any company can be undermined if the customer support team is slow to

react, responds unprofessionally and takes a long time to resolve client problems.

Therefore, it is important to get an impression of how the company communicates with

you and how interested the company is in helping you in particular.

Price

It is not always worth chasing after popular liquidity providers as they often offer

higher prices for the same and sometimes even lower quality service, charging a

premium for their name. It is the service that counts for your clients.

Therefore, when choosing a provider, focus on their professionalism.